After serving the nation being An IAS are Jawahar sir and his ilk seriously naive to make this foolish comparison

India’s external debt rose 8% in FY’22 to $620.7 billion as short-term debt rose 20% during the year. Debt to GDP ratio declined marginally to 19.9 percent,

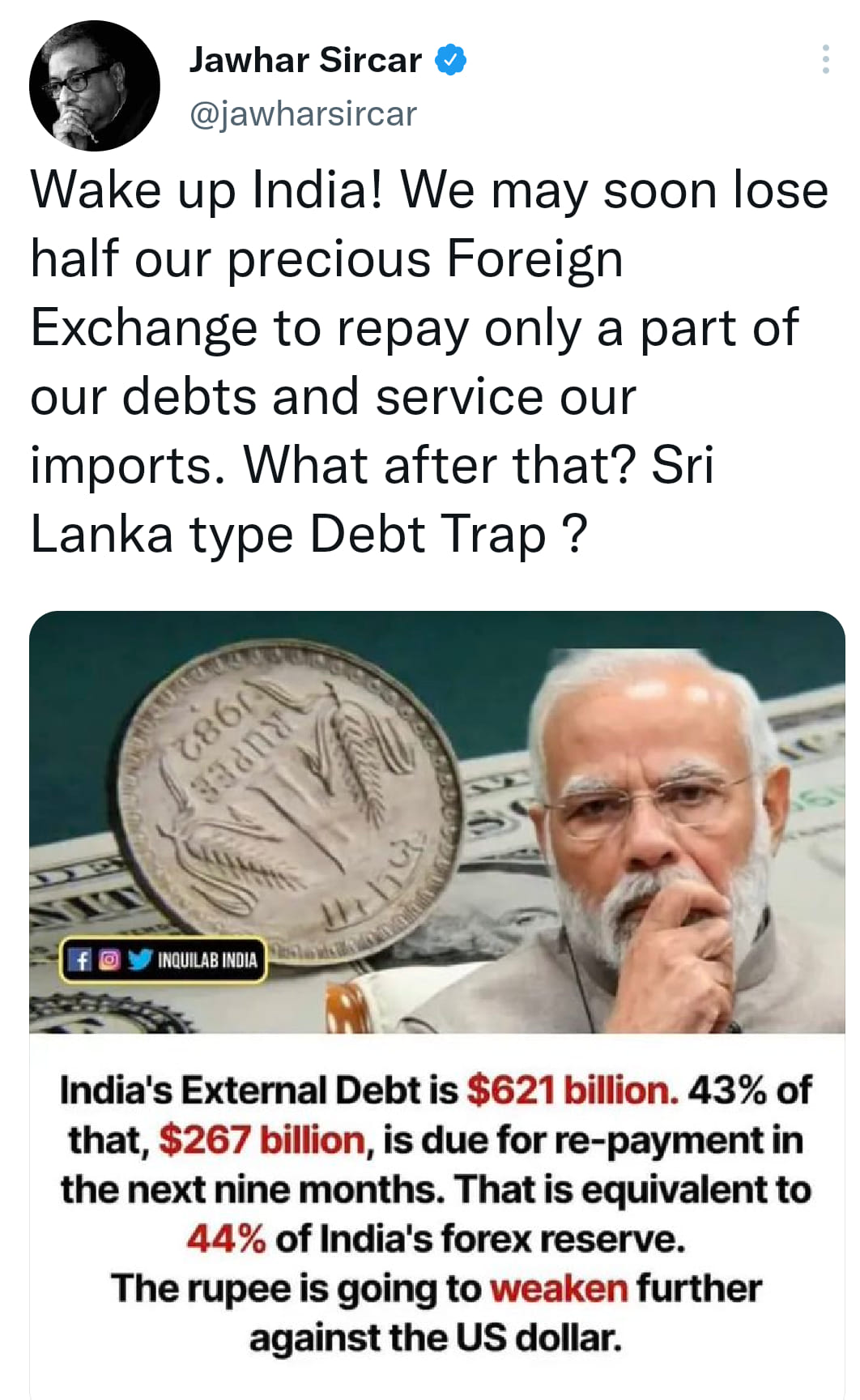

The fear mongering he is trying to create behind the 44% of India’s external debt coming due is vague. Here is Short-term debt on a residual maturity basis as a % of total external debt as of March end by year

2017:41.6%

2018:42%

2019:43.4%

2020:42.4%

2021:44.1%

2022:43.1%

Debt service (i.e., principal repayments and interest payments) declined to 5.2% of current receipts at end-March 2022 as compared with 8.2% at end-March 2021, reflecting lower repayments and higher current receipts. The external debt to GDP ratio declined to 19.9% at end

2022 from 21.2% at end-March 2021.

External debt to GDP ratio has declined since FY14

India saw current account surplus of 0.9% in Q1FY22 on top of similar surplus in FY21 after gap of 17 yrs

On the other hand, India saw highest ever current account deficit(CAD) of 4.8%

in FY12 during Congress Regime

India’s record $25.6 billion trade deficit in June adds pressure on Rupee.

The credit-Deposit Growth gap widens to a 3-year high of nearly 5% credit growth at 13.2% and Deposit Growth at 8.3%.

India’s foreign exchange reserves, which can cover about 10 months of imports,

have slumped more than $50 billion from a peak in September to $587 billion in the week of June 17 as the RBI seeks to stabilize the currency and importers seek more dollars for costly energy imports.

India’s trade deficit widened to an all-time high of $24 billion in May,

after the nation’s import bill almost doubled because of a surge in global crude oil prices. Meanwhile, exports slowed as Russia’s invasion of Ukraine and tighter

Foreign investors have pulled out more than $32 billion from Indian equities in the last year,

The RBI given break-up of the External debt which is only $130.8 B (22% of Forex reserve). The non-govt debt is at $490 B, which will NOT be serviced by the govt. The non-govt External debt also includes borrowings by individual companies.

The non-govt ED is not serviced by the Forex reserve. These borrowings (ECB) will be serviced by the pvt companies.

Now Sri Lanka’s problem is about one thing largely-living beyond one’s means

Sri Lanka’s External Debt to GDP ratio is 40.4%,with just $2bn Forex reserves

GDP $82bn

External Debt $52bn

Ext Debt as % of GDP 63.41%

Forex Reserves $1.9bn

Whereas India’s External Debt to GDP is only 19.8%,with massive Fx reserves of $597.73bn,4th Highest Globally

GDP $3.05 Tn (6th Biggest Economy

External Debt $620bn

Ext Debt as % of GDP 20.63%

India’s Fx reserves have grown steady clip over 3 yrs, ₹ has been a remarkably stable currency for 8 yrs. RBI purchases of G-sec, via GSAP/OMO, on a net basis does not fund more than 10-15% of aggregate borrowings for a fiscal.

India now attracts about 2% of FDI inflows.

It needs more. FDI flows are stickier & beyond capital, brings a lot of benefits like headcount demand, supply linkages with the world, technology transfer & beyond.

India needs to play both the short & the long game, esp the FDI game.

RBI announced a slew of measures to liberalise forex flows in local market.

There are two ways to look at the broad brush of measures announced. One is – extraordinary times require extraordinary measures, or second is, desperate

times lead to desperate measures.

it’s up-to others to decide how they look at the measures, esp. in the context where most of steps taken are to attract short

term flows. We have seen such ad-hoc measures in past episodes of rupee depreciation as well, with little impact.

We have to accept the fact rupee is facing problem on both current (rising trade deficit) and capital account (outflows) side, in the backdrop where external environement for dollar is quite supportive and financial condition is getting tighter

The FED commitment to bring the inflation down, even at the cost of sacrificing growth, if needed. *No doubt, economic data coming from DMs, including US have softened a bit of late, but when it is seen on relativebasis, US vs ROW, former still stands out, giving an upper hand to dollar and reason for FED to remain

hawkish for longer, than its peers. Remember, currency is all about relative trading.

In such a scenario, where external environement remains hostile, we continue to believe that measures

announced by RBI might have some

salutary effect on INR in short term, but does not change the broad

direction of $INR to 80/81.

Possibly, pull-back can be a good level for importers to increase hedge ratio. Let’s see how long it sustains though

To our mind, softening oil can have bigger macro support to INR than these short term measures and luckily oil in last 2-3 days have come off quite a bit. But for a sustained pull back in INR, we need further softening in oil along with FED to pivot and external environment to ease as well.

Rupee again today closed at a new low against dollar, at 79.43 in spot, after dollar index made a new high riding on better than expected payroll number last Friday.

In last 15 days, there was an increasing chatter in market that central banks across the world, including FED might slow the pace of rate hike, looking at softer

economic data coming from different parts of the world.

As a result, we saw some decent recovery in risk assets as well, largely driven by equities.

But last week data from US, possibly, put to rest the narrative around economic slowdown in US, and thus any change in rate hike trajectory guided by FED. In fact,

a higher than expected US CPI print, later this week, on Wed, can further put dollar on a firmer note.

Given that currency is all about relative trading, even if US data softens, but lesser than RoW, dollar can continue to outperform.

Remember, US dollar still remains the cleanest dirty shirt in laundry.

While FED has already hiked the rate by 150 bps so far and is committed to hike further to tame the inflation, its counterparts are still to keep pace or take the first baby step.

Also, from FED perspective, a stronger dollar helps in reining-in inflation as it makes the import cheaper for

US and tightens the financial conditions, both at local and global level.

In this backdrop, where dollar assets look to be the most attractive in world, in relative terms, we continue to see rupee on a slow and steady depreciation until

capital flows moves in and FED pivots.

No worry on sustainability and expansion of FC reserves

So, no panic noise!

It’s no comparison of Sri Lankan crisis as lesson for India, specially when India aspiration into G3 is work in progress at good speed exhibiting resilience capabilities when are in struggle to weather the storm of pandemic & geopolitical woes

An unhedged ECB is zero-sum game on aggregated basis on India’s external debt

with US 10Yr at 3% and expected rise to 3.5-3.75% post Fed mtg..India Forex borrowing will have big spread as well + plus Re Depreciation, so return on debt will have to be very high else it’s a

debt trap.

Those who access offshore markets for debt (as alternate to onshore INR borrowing) would do only based on spread/arbitrage advantage from FC borrowing!

What really matters is the cost on incremental reserves!

Which is the spread between yield

from building USD assets and cost of losing INR assets

The (negative) spread is on decline now, so it’s advantage India!